09 Sep The Housing Bubble In Dangerous Times Prepare For A Safe Landing With Your 401 K

The Housing Bubble In Dangerous

Times – Prepare For A Safe Landing

With Your 401 K

How long can home prices keep rising?

The median sales price of an existing single-family home in the United States reached 391,200 U.S. dollars in April 2022 – the highest price on record.

According to Bloomberg, home sellers are slashing prices in a sudden halt to the pandemic boom. The rapid rise in mortgage rates is cooling down the demand, jostling markets from coast to coast.

As reported in Barrons: Imagine an America where more than 100 million people about 1 in every 3 don’t have enough money to pay for their needs at the most vulnerable time of their adult lives. We are well on our way to living in that America, where people we all know our teachers, coaches, spiritual leaders, and maybe even our parents face financial insecurity and risk becoming a burden on future generations.

Key findings also report that – In June 2022, 61% of Americans were living paycheck to paycheck, up from a low of 52% in April 2021 and 55% in June 2021.

> Best Advice: Start Saving Early For Retirement!

If your company offers a 401K, at least put in the amount the company matches. It is usually deducted from your paycheck before taxes, so in probability, you won’t even notice the deduction.

Albert Einstein once stated years ago, “Compound interest is the eighth wonder of the world. He who understands it earns it … he who doesn’t … pays it.”

Simply stated “Compound interest is the interest you earn or pay on interest.”

The U.S. Securites and Exchange Commission also gives a good example: if you have $100 and it earns 5% interest each year, you’ll have $105 at the end of the first year. At the end of the second year, you’ll have $110.25.

Not only did you earn $5 on the initial $100 deposit, you also earned $0.25 on the $5 in interest. While 25 cents may not sound like much at first, it adds up over time. Even if you never add another dime to that account, in 10 years you’ll have more than $162 thanks to the power of compound interest, and in 25 years you’ll have almost $340 Investor.Gov

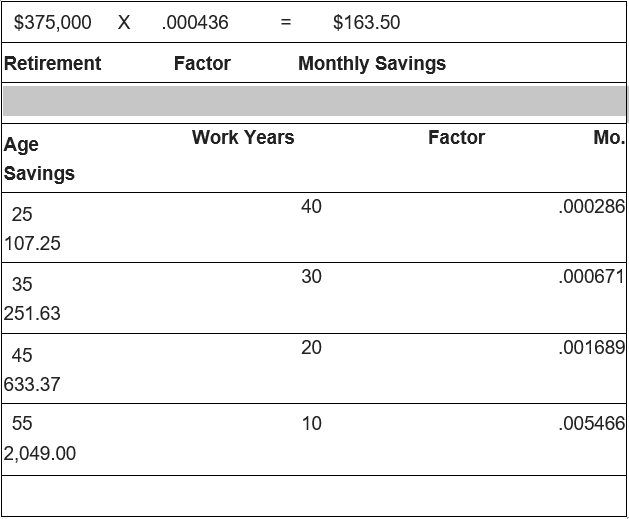

There is also a great formula to determine how much you should save each month if you plan on retiring at age 65 with $375,000.

As an example, assuming your income is $30,000 per year and inflation is at 4% which would net 8% after inflation.

According to the IRS, you can contribute up to $20,500 to your 401(k) for 2022. By comparison, the contribution limit for 2021 was $19,500. This number only accounts for the amount you defer from your paycheck — your employer matching contributions don’t count toward this limit

If you do the math, you will see why it pays to start retirement savings early. If you are in a position to “max out” your 401 K, you will be a happy camper at retirement.

* Excerpts From The Book “Surviving The Corporate Culture”

Robert Michael Lehmann

By wisdom a house is built, and through understanding it is established; through knowledge is rooms are filled with rare and beautiful treasures. Proverbs 24:3